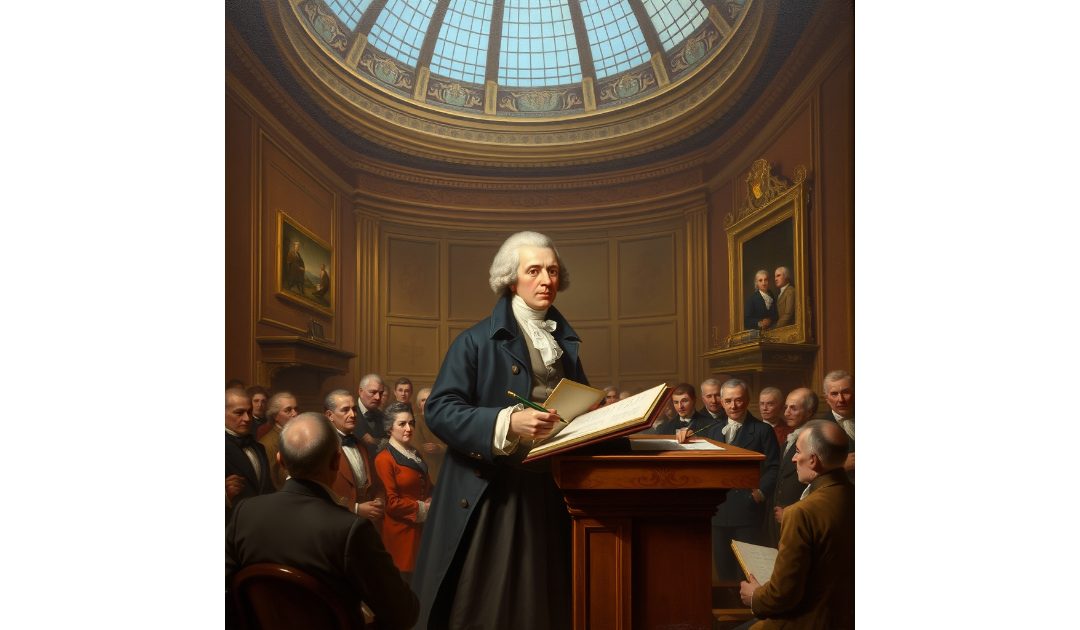

On the 9th of January 1799 the Prime Minister, William Pitt the Younger, introduced income tax in order to raise money for the war against Napoleon. I’ve written about tax before, a necessary burden for a just society.

William Pitt the Younger was a prominent British statesman who served as Prime Minister from 1783 to 1801 and again from 1804 to 1806. Born on May 28, 1759, he was the son of William Pitt the Elder, a notable politician in his own right. Educated at Cambridge, Pitt entered Parliament at a young age and quickly rose through the ranks due to his oratory skills and political acumen.

Pitt became Prime Minister at just 24, making him the youngest person to hold the office. His leadership during a tumultuous period included navigating the challenges posed by the American Revolutionary War and the subsequent conflicts with France during the French Revolutionary and Napoleonic Wars. He is credited with significant financial reforms, including the introduction of income tax in 1799 to fund the war effort.

Before the introduction of income tax in the UK in the early 19th century, the government relied on various other forms of taxation to generate revenue. The primary sources of tax revenue included indirect taxes, property taxes, and customs duties.

One of the most significant forms of taxation was the land tax, which dates back to the 1692 Land Tax Act. This tax was levied on landowners based on the estimated rental value of their properties. It was a relatively straightforward way for the government to raise funds, especially in an agrarian society where land ownership was a key indicator of wealth.

Customs duties were another major source of revenue. The government imposed taxes on goods imported into the country, which were particularly significant during the expansion of trade in the 18th century. These duties not only generated income but also served to protect domestic industries by making imported goods more expensive.

Excise taxes were also prevalent, applied to specific goods such as alcohol, tobacco, and sugar. These taxes were levied on production and sale, contributing significantly to the treasury. The Beer Act of 1830, for instance, aimed to reduce the price of beer while increasing tax revenue through volume sales.

Additionally, poll taxes and window taxes were implemented at various times, taxing individuals and properties based on the number of windows a house had. However, these taxes were often unpopular and led to public discontent.